Business Structure Tax Calculator

Stop guessing. Use our free AI-powered Business Structure Tax Calculator to compare LLC, S-Corp, C-Corp, and Non-Profit structures — and discover which one is tax-efficient and puts more money in your pocket.

Tax Comparison Results

| Metric | LLC | S-Corp | C-Corp | Non-Profit |

|---|---|---|---|---|

| Total Estimated Taxes (Federal + State) | $0 | $0 | $0 | $0 |

| Self-Employment Tax vs. Payroll Tax | $0 | $0 | N/A | N/A |

| Owner's Take Home Pay | $0 | $0 | $0 | N/A |

| Payroll Requirements | No | Yes | Yes | Yes (if staff) |

| Corporate Tax Rates | Pass-Through | Pass-Through | 21% | Exempt |

Tax Savings Estimator: Calculating...

AI Recommendation: Calculating...

Quick Summary: Our Top 3 Picks for Formation Agent

- Zero Cost for Year One

- State Fee Inclusion

- Tailored for the USA

- Automatic Chatbot Assistance

- Personalized Package Selection

- Efficient Decision-Making

- User-Friendly Design Options

- Direct Companies House Integration

- Trusted by Satisfied Customers

Compare Business Structures with Ease

Our Business Structure Tax Calculator allows you to evaluate the tax implications of different business entities—Sole Proprietor/LLC, S-Corp, C-Corp, and Non-Profit—in a few simple steps.

By inputting details such as your annual income, business revenue, expenses, and owner’s salary, the tool calculates federal, state, and self-employment taxes for each structure.

It provides a detailed comparison table showing metrics like total estimated taxes, payroll requirements, and take-home pay, helping you understand which structure minimises your tax burden.

Whether you’re a freelancer, small business owner, or nonprofit founder, this tool empowers you to make informed decisions about your business structure with clear, actionable insights.

AI-Powered Recommendations for Optimal Decisions

The calculator leverages AI to deliver personalised recommendations tailored to your financial situation and business objectives.

After collecting inputs like your filing status, state of residence, business goals (e.g., saving on taxes, simplifying compliance, or qualifying for grants), and reinvestment plans, the AI analyses the data to suggest the most suitable structure.

For example, if your priority is minimising self-employment taxes, it might recommend an S-Corp; if you’re focused on grant eligibility, a Non-Profit might be advised.

The recommendation comes with a detailed explanation, such as how much you could save by switching structures, ensuring you understand the reasoning behind the suggestion.

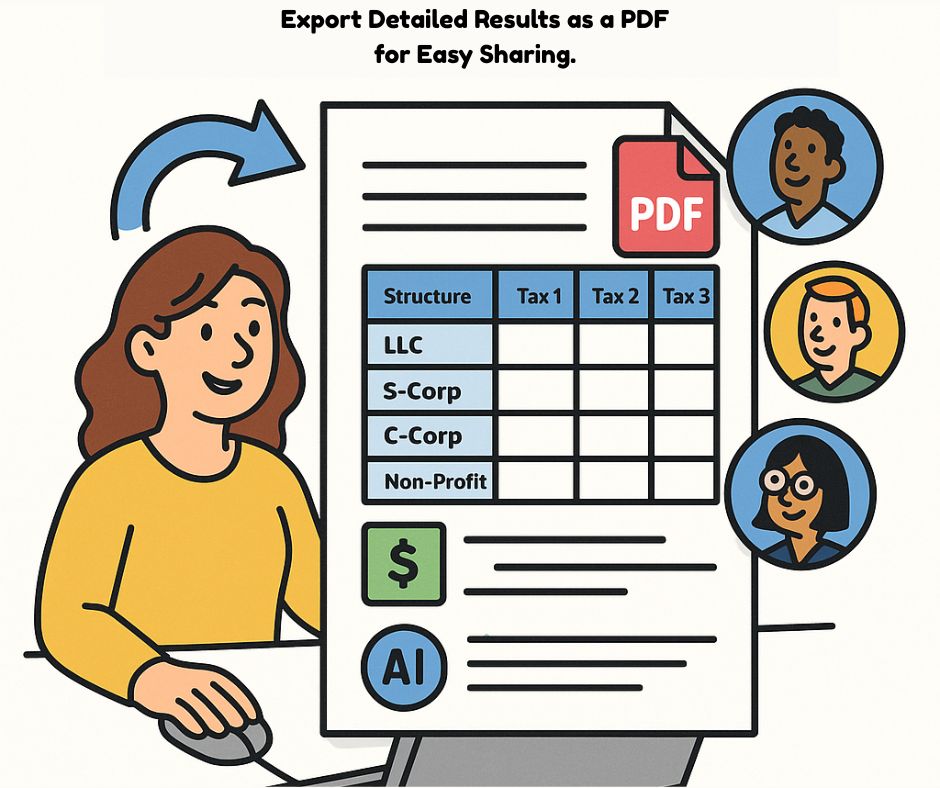

Export Detailed Results as a PDF for Easy Sharing.

Once you’ve calculated your tax comparisons, the tool allows you to export your results as a professional PDF document with just one click.

The PDF includes a comprehensive table comparing tax metrics across all selected structures, a tax savings estimator (e.g., how much you could save by switching from an LLC to an S-Corp), and the AI-generated recommendation with its rationale.

This feature is perfect for sharing with business partners, accountants, or financial advisors or for keeping a record of your analysis.

The export functionality ensures you can easily access and distribute your results without needing to re-run the calculator.

Is the Business Structure Tax Calculator really free, or are there hidden costs?

Yes, the calculator is 100% free to use, with no hidden costs or subscription fees.

We designed it to be accessible to everyone, whether you’re a solo entrepreneur or running a larger organization.

There are no limits on how many times you can use it, and you can export your results as a PDF at no charge.

Our goal is to provide a valuable resource to help you make informed financial decisions without any financial barriers.

Which business structures can I compare using this calculator, and why does it matter?

You can compare four business structures: Sole Proprietor/LLC, S-Corp, C-Corp, and Non-Profit. Each structure has unique tax implications that can significantly impact your finances.

For example, an LLC offers pass-through taxation but requires self-employment taxes, while an S-Corp can reduce self-employment taxes by allowing a reasonable salary and dividends.

A C-Corp faces double taxation but may benefit businesses reinvesting profits, and a Non-Profit is tax-exempt but must meet specific IRS criteria.

Comparing these helps you choose the structure that aligns with your financial goals, such as minimizing taxes or simplifying compliance.

How does the calculator determine the best business structure for my needs?

The calculator uses an AI-driven algorithm to analyze your inputs and recommend the best structure.

It considers factors like your filing status (e.g., single, married filing jointly), total income, state of residence, business revenue, expenses, owner’s salary, number of owners, and primary goals (e.g., saving on taxes, minimizing self-employment tax, keeping compliance simple, or qualifying for grants).

For instance, if your goal is to minimize self-employment taxes and your net income is high, the AI might recommend an S-Corp due to its ability to split income between salary and dividends, reducing your tax liability.

The recommendation includes a detailed explanation to help you understand the logic behind the suggestion.

Can I export my tax comparison results, and what’s included in the export?

Yes, you can export your results as a PDF with a single click using the “Export To PDF” button.

The PDF includes a detailed comparison table showing metrics like total estimated taxes (federal and state), self-employment or payroll taxes, owner’s take-home pay, payroll requirements, and corporate tax rates for each structure you selected.

It also includes a tax savings estimator (e.g., how much you could save by switching from an LLC to an S-Corp) and AI-generated recommendations with their rationale, such as why a particular structure is best for your goals.

This comprehensive report is ideal for sharing with stakeholders or keeping for your records.

Does the calculator account for both federal and state taxes in its calculations?

Yes, the calculator accounts for both federal and state taxes to give you a complete picture of your tax liability.

Federal taxes are calculated using simplified 2025 tax brackets (e.g., 12% for income up to $60,950, 22% above that for single filers), while state taxes are estimated at a flat 5% rate for demonstration purposes.

The tool also factors in self-employment taxes (15.3% for LLCs) and payroll taxes (for S-Corps and C-Corps), as well as deductions like the Qualified Business Income (QBI) deduction for pass-through entities.

This ensures a realistic estimate tailored to your location and business structure.

How accurate are the tax calculations, and can I rely on them for tax planning?

The tax calculations are designed to provide a realistic estimate based on simplified IRS rules, including federal tax brackets, self-employment tax rates (15.3%), corporate tax rates (21% for C-Corps), and a flat 5% state tax rate for demonstration.

It also applies deductions like the QBI deduction (20% of net income for pass-through entities) where applicable.

While the results are useful for comparative purposes and initial planning, they are not a substitute for professional tax advice.

Tax laws can be complex and vary by state, so we recommend consulting a tax professional to confirm your specific tax obligations before making decisions.

Can I use this calculator for an existing business, or is it only for new businesses?

The calculator is versatile and works for both existing businesses and those planning to start one.

In the “Business Details” section, you can specify whether you already have a business entity (Yes/No).

If you select “Yes,” the tool assumes you’re evaluating a potential change in structure (e.g., from an LLC to an S-Corp).

If you select “No, I’m planning to start one,” it helps you choose the best structure from the outset.

The calculator’s inputs, like revenue, expenses, and owner’s salary, are relevant to both scenarios, making it a valuable tool for any stage of your business journey.

What happens if I don’t know my owner’s salary or other specific financial details?

The calculator is designed to handle incomplete data gracefully.

If you don’t know your owner’s salary, you can leave the field blank, and the tool will estimate a reasonable salary for certain structures (e.g., for an S-Corp, it assumes 40% of net income as salary to calculate payroll taxes, with the rest treated as dividends).

Similarly, fields like health insurance premiums are optional and only affect specific deductions like QBI or self-employment tax adjustments.

The tool will still provide a comparison based on the data you do provide, though entering more details will yield more accurate results.

You can always run the calculator multiple times with different inputs to explore various scenarios.