Last Updated on 3 days by Komolafe Bamidele

After using FreshBooks daily for the past year as an accountant managing multiple clients, I’m ready to share my unfiltered experience.

While QuickBooks often feels like you need an accounting degree to navigate it, FreshBooks positions itself as the user-friendly alternative.

But does it deliver? Here’s my honest assessment after 12 months of real-world usage.

What Sets FreshBooks Apart in 2025

FreshBooks is a cloud-based accounting solution that utilizes double-entry accounting to minimize errors while maintaining an intuitive interface that doesn’t intimidate non-accountants.

As someone who works with various small businesses, I’ve found that FreshBooks truly excels at making financial management accessible.

When comparing it to industry giants like QuickBooks, FreshBooks consistently wins on both pricing and appeal to self-employed professionals and small businesses.

What makes it particularly attractive is how quickly you can accept online payments directly within invoices, customize invoice styles to match your brand, and schedule recurring invoices to bill clients automatically.

In other words, this intuitive platform saves valuable time by streamlining how you get paid – something every business owner can appreciate. Check out the company’s official website to see these features in action.

Who Gets the Most Value from FreshBooks?

After extensive use, I can confidently state that FreshBooks best serves three primary user groups:

Freelancers Who Need Simplicity

FreshBooks is built for you if you’re a freelancer without formal accounting experience.

It perfectly balances professional functionality and ease of use, allowing you to manage invoices, track time, and monitor expenses without the typical accounting software learning curve.

The time tracking feature is particularly valuable – you can track hours with pinpoint accuracy and directly integrate them into your invoices, ensuring you get paid for every minute worked.

Small Businesses (Under 50 Employees)

For small teams stretched thin on resources, FreshBooks delivers tangible benefits. The automated invoicing, straightforward expense tracking, and accelerated payment processes help maintain financial clarity without consuming precious time.

I’ve personally set up several small business clients with FreshBooks, and they consistently report spending less time on financial tasks and more time focusing on core business operations.

Service-Based Businesses

If your business provides services rather than physical products, FreshBooks is specifically optimized for your workflow.

The time tracking and project management capabilities make it simple to manage client projects and ensure accurate billing.

However, I’ve noticed that while FreshBooks includes items and services tabs, it’s not as robust as alternatives like Zoho Books for inventory management.

You’ll need to make manual stock adjustments as new items arrive – a consideration for businesses with product-based operations.

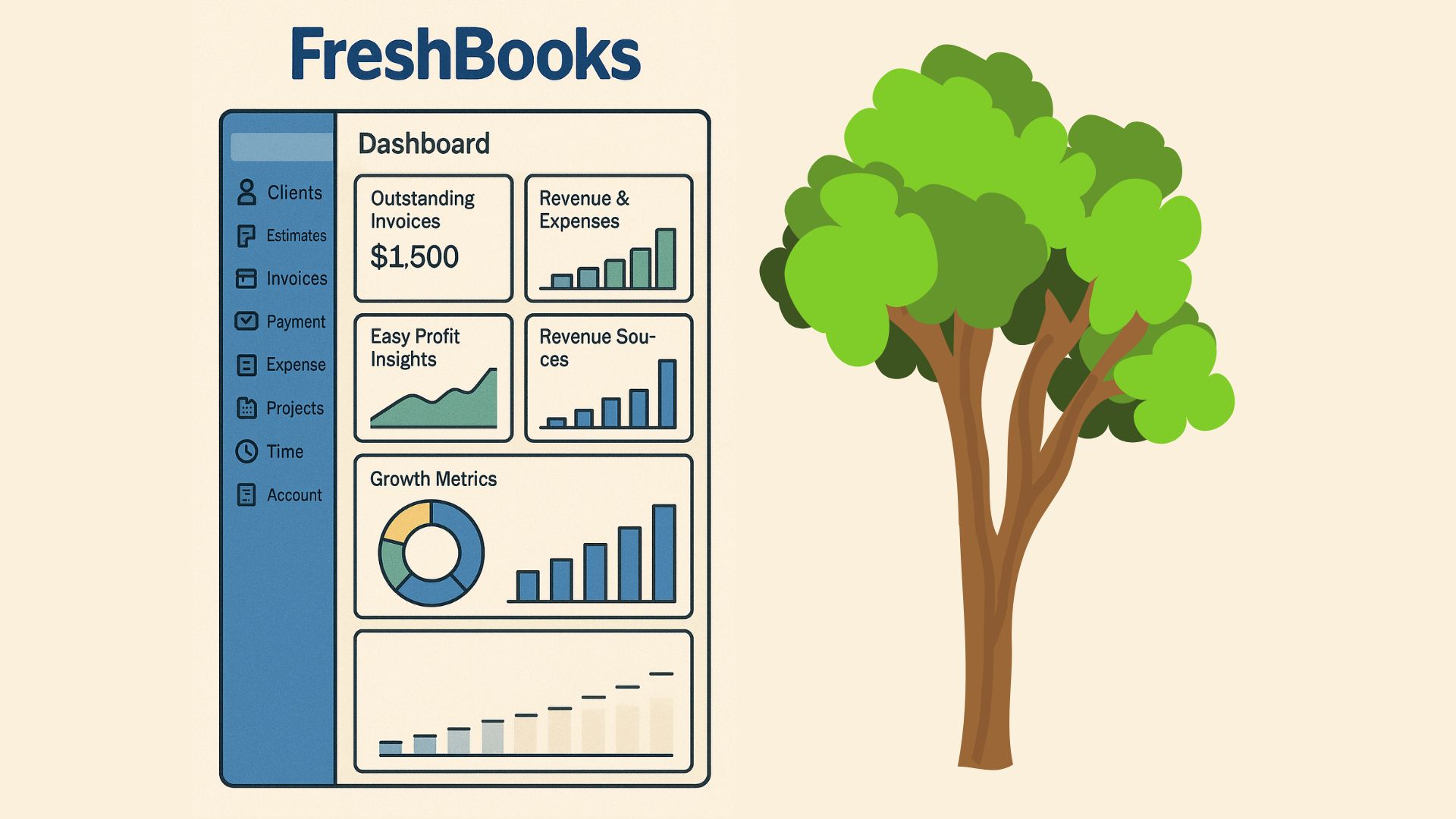

The Interface: Navigation Without Frustration

The FreshBooks interface is genuinely intuitive – a claim many software companies make but few deliver on.

Unlike QuickBooks, which often overwhelms users with options, FreshBooks presents a clean, logical layout that even accounting novices can navigate with confidence.

When you log in, the dashboard immediately shows your financial health at a glance:

- Outstanding invoices needing attention.

- Revenue and expense metrics with clear visualizations.

- Profit analysis that makes sense to non-accountants.

- Revenue stream breakdowns showing where your money comes from.

- Performance metrics that track business growth.

The left navigation provides quick access to all essential functions:

- The clients section for managing customer information

- Estimates and proposals for prospective work

- Invoices for efficient billing management

- Payment tracking for monitoring cash flow

- Expense management for tracking costs

- Projects for managing client work

- Time tracking for billable hours

- Accounting for financial reports and insights

This structured approach follows your natural workflow, making daily accounting tasks significantly more efficient. Visit FreshBooks now to experience this streamlined interface.

Invoicing That Actually Gets You Paid

The invoicing functionality is where FreshBooks truly outperforms competitors. After creating countless invoices over the past year, I’ve come to appreciate several standout features:

Customization That Reflects Your Brand

FreshBooks offers three distinct template styles: simple, modern, and classic. While I initially wished for more options, these templates provide sufficient customization for creating professional invoices. You can:

- Add your company logo for brand consistency

- Select from preset theme colors or enter hex codes for perfect matching

- Choose between modern or classic font styles

- Include personalized notes and payment terms

Efficient Creation Process That Saves Time

The invoice creation workflow is remarkably efficient – everything happens on a single screen where you can:

- Add line items with descriptions and prices

- Select billable clients from your database

- Attach supporting documentation

- Edit templates as needed

- Set up recurring schedules for regular billing

This streamlined approach has saved me hours each month compared to other platforms I’ve used.

Automation That Works While You Sleep

FreshBooks excels at automation, offering:

- Recurring invoice scheduling for consistent billing

- Automatic payment reminders that maintain cash flow

- Late fee application for overdue payments

- Online payment options that accelerate collections

The recurring invoice function has been particularly valuable for my retainer clients, ensuring consistent billing without manual intervention.

Payment Processing: Multiple Options for Faster Collection

Getting paid quickly matters, and FreshBooks facilitates this with multiple payment options:

Credit Card Processing

FreshBooks Payments enables clients to pay invoices directly using major credit cards, with transaction fees of 2.9% plus $0.30 for Visa, Discover, and MasterCard transactions.

While these rates are industry standard, they provide convenience that often results in faster payments.

Bank Transfers

For clients who prefer direct transfers, FreshBooks supports bank transfers with a 1% fee, significantly lower than credit card processing rates and a good option for larger invoices.

Third-Party Integration

The platform connects seamlessly with Stripe and PayPal, each with its own fee structures. This flexibility allows clients to use their preferred payment method, increasing the likelihood of prompt payment.

The Select subscription plan offers reduced transaction fees, which can deliver substantial savings for businesses processing high payment volumes.

Time Tracking: Capturing Every Billable Minute

The time tracking capabilities in FreshBooks are robust and purpose-built for service providers:

Intuitive Timer Functionality

The built-in timer allows precise tracking as you work on client projects. You can launch it directly from the dashboard and associate hours with specific clients and projects, ensuring accurate billing.

Mobile Accessibility For On-The-Go Professionals

The mobile app includes full-time tracking functionality, enabling you to record hours even when working remotely or on-site with clients – a feature I’ve used extensively when working away from my desk.

Seamless Invoice Integration

The most valuable aspect is how tracked time entries can be automatically added to invoices with a single click. This eliminates double-entry and ensures you capture all billable time without manual calculations.

Client Management: Building Stronger Relationships

After managing dozens of clients through FreshBooks, I’ve found several features particularly valuable:

Client Portal That Empowers Customers

The client portal is a standout feature, allowing clients to:

- View and pay invoices without creating an account

- Check project status and progress

- Access their billing history

- Print invoices, estimates, and proposals as needed

This self-service approach reduces administrative work while giving clients transparency into their financial relationship with your business.

Communication Tools That Maintain Professionalism

FreshBooks integrates communication tools directly into the platform, enabling you to send professional emails with invoices and follow up on outstanding payments without switching applications.

Client Limitations To Consider

It’s important to note that FreshBooks restricts the number of clients based on your subscription level:

- Light plan: 5 clients

- Plus plan: 50 clients

- Premium plan: Unlimited clients

These limitations are worth considering when selecting your plan, as upgrading can become necessary as your client base grows. Learn more about plan options.

Reporting Capabilities: Financial Insights That Matter

FreshBooks provides over 20 standard financial reports, covering essential business intelligence needs:

Core Financial Statements

- Profit and Loss statements that show your bottom line

- Balance Sheet reports for understanding assets and liabilities

- General Ledger overview for detailed transaction tracking

- Cash Flow analysis for monitoring liquidity

Business Performance Insights

- Revenue by client to identify your most valuable relationships

- Expense categories to control costs

- Tax summary reports for simplified compliance

- Accounts aging to manage receivables

While the reporting suite isn’t as extensive as some competitors, it covers the essential needs of most small businesses. You can easily customize reports by date range and switch between accrual and cash basis accounting as needed.

Pricing Structure: Understanding Your Investment

FreshBooks offers tiered pricing that scales with your business needs:

Lite Plan ($6.30/month)

- Limit of 5 billable clients

- Unlimited invoices

- Basic expense tracking

- Online payment acceptance

Plus Plan ($11.40/month)

- Up to 50 billable clients

- All Light features

- Automated recurring invoices

- Double-entry accounting

- Advanced reporting

Premium Plan ($19.50/month)

- Unlimited billable clients

- All Plus features

- Project profitability analysis

- Custom email templates

- Two free team member accounts

All plans include just one user, with additional users costing $11/month each (except Premium, which includes two team members). You can save 10% with annual subscriptions.

Integration Capabilities: Connecting Your Business Tools

FreshBooks offers approximately 140 integrations – fewer than QuickBooks’ 750+, but covering most essential business tools:

Key Integrations

- Payment processors (Stripe, PayPal)

- CRM systems for customer management

- Project management tools

- E-commerce platforms

- Tax preparation software

The platform also provides a well-documented API for custom integrations, offering flexibility for businesses with specific requirements.

Limitations I’ve Encountered: The Full Picture

After daily use for a year, I’ve identified several limitations worth considering:

Limited Inventory Management

For businesses selling physical products, FreshBooks falls short in inventory capabilities:

- No purchase order functionality (available in QuickBooks Plus)

- Lack of inventory forecasting

- No reorder alerts

- Manual stock adjustments required

If inventory management is central to your business, you might need supplementary software or an alternative solution.

Client Restrictions on Lower Tiers

The client limits on lower-tier plans can be restrictive as your business grows. The Light plan’s 5-client limit is particularly constraining, potentially forcing an upgrade sooner than expected.

Some Advanced Accounting Limitations

While FreshBooks handles everyday accounting well, it lacks some advanced features that growing businesses might eventually need:

- Detailed departmental accounting

- Comprehensive multi-currency management

- Complex tax handling for multiple jurisdictions

My Year With FreshBooks: The Honest Verdict

After 12 months of daily use, I rate FreshBooks 8.5/10 for its combination of user-friendliness, core functionality, and value for small businesses and freelancers.

What I Genuinely Love

- The intuitive interface that requires minimal training

- Efficient invoice creation and management

- Robust time tracking with direct invoice integration

- The client portal that improves communication

- Reliable customer support with knowledgeable representatives

Areas Needing Improvement

- More invoice template options would enhance customization

- Inventory management needs significant enhancement

- Reporting capabilities could be expanded for growing businesses

- Credit card payment classifications could be clearer in the system

- Retainer management should offer options beyond hourly tracking

Is FreshBooks Right For You?

Based on my extensive experience, I confidently recommend FreshBooks for:

- Freelancers and solo entrepreneurs prioritizing simplicity

- Service-based businesses with straightforward accounting

- Small teams needing efficient invoicing and time tracking

- Businesses transitioning from spreadsheets to proper accounting

However, consider alternatives if:

- You maintain extensive inventory

- Your accounting needs are highly complex

- Your business is scaling rapidly beyond small business status

- You require advanced customization for financial reporting

As your business evolves, you may eventually outgrow certain aspects of FreshBooks, but until that point, it provides an excellent foundation for financial management without unnecessary complexity.

So, what are you waiting for? Just get started. Check out the company’s official website.

After using FreshBooks intensively for a year, I can confidently recommend it as a reliable, efficient accounting solution for small businesses and freelancers. The platform strikes an impressive balance between user-friendliness and essential functionality that few competitors can match.

With a free trial available, you can explore all features before committing to a subscription.

This hands-on experience will quickly demonstrate how FreshBooks can streamline your financial management and help your business maintain financial clarity without consuming excessive time or resources.

Visit FreshBooks today to discover how the right accounting software can transform your financial management experience.

Discover more from Zenith Techs

Subscribe to get the latest posts sent to your email.